June 4, 2018

PACICC Visits Dr. Wells for Emerging Risks Webinar

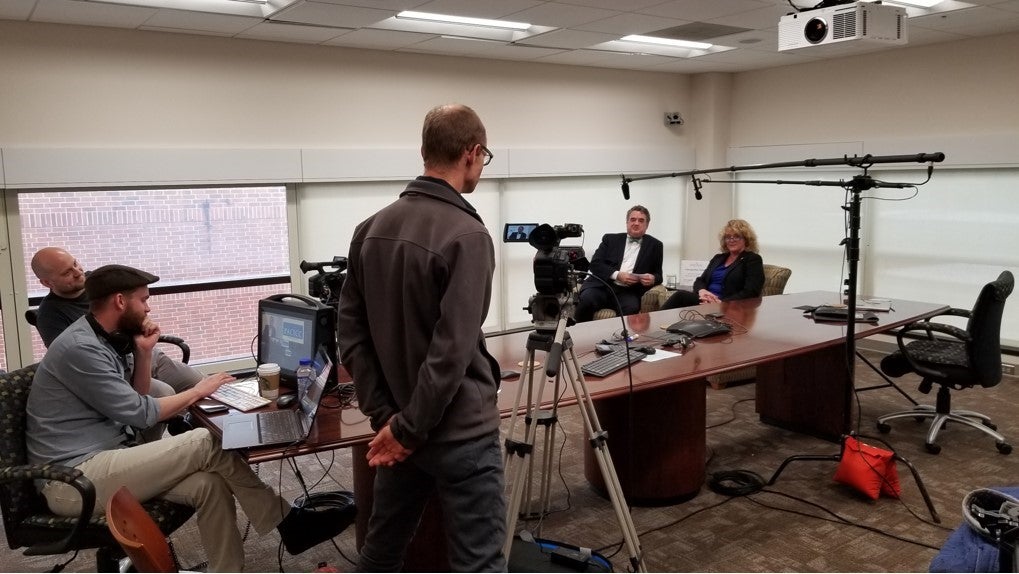

COB’s Dr. Brenda Wells, far right, participates in a property and casualty insurance webinar for PACICC

ECU’s Risk Management and Insurance Program figured prominently in a recent webinar beamed live from the College of Business to major Property and Casualty (P&C) insurance companies across Canada.

Dr. Brenda Wells (Robert F. Bird Distinguished Professor, Risk Management and Insurance and Director, Risk Management and Insurance, College of Business) was the featured speaker in a webinar organized by the Property and Casualty Insurance Compensation Corporation (PACICC) on the topic “Marijuana Legalization: Implications for P&C Insurance.” Ian Campbell (vice president, Operations, PACICC) traveled to the ECU campus to interview Dr. Wells for this 90-minute broadcast. Said Mr. Campbell, “I was delighted to visit East Carolina University and tour the College of Business. This (College of Business) is a state of the art facility with an impressive Risk Management and Insurance program.”

Click here to view the webinar.

Dr. Wells is a recognized expert in this field of study. PACICC is Canada’s guarantee fund for P&C insurance industry, providing financial protection to insurance consumers across Canada in the event of an industry insolvency. Mr. Campbell organizes Emerging Risks Webinars for PACICC throughout the year, inviting industry experts to share insights into emerging risk issues that have caught the attention of senior risk officers in the industry.

Ian Campbell, vice president at PACICC (left), interviews Dr. Brenda Wells on the topic of marijuana legalization: implications for P&C insurance

Legalization of marijuana is a major issue in Canada right now. It was an election promise of Canadian Prime Minister Justin Trudeau in the last federal election. His government introduced enabling legislation in early 2017 – Bill C-45 (An Act respecting cannabis and to amend the Controlled Drugs and Substances Act, the Criminal Code and other Acts) – with plans to have it implemented by July 1, 2018. The legislation is currently being debated in Canada’s Senate, with passage expected soon.

“It does not matter whether one is opposed to or in favor of marijuana legalization,” said Wells. “The fact is that more than 50 percent of the U.S. population now has access to marijuana, either for medical or adult use. The ‘someday’ of marijuana legalization is finally here, and most industries, including the insurance industry, are simply not prepared for the consequences. This (marijuana industry) stands to become a $20 billion market in the U.S. so it cannot be ignored.”

During the webinar, Dr. Wells fielded questions from chief risk officers in 50 insurance companies spread across Canada. This event was highly anticipated in the Canadian P&C insurance industry. Mr. Campbell noted that the number of participants registered for this event was easily double the number that usually register. Past PACICC webinars have focused on other emerging risk issues, including cybersecurity, autonomous vehicles, on-demand insurance, demographic and generational change and the “Smart Factory” (innovative new technologies in the P&C insurance industry).

- Categories:

- Risk Management & Insurance