February 1, 2021

GameStop and the saga of short selling

Let’s assume an investor believes that the stock of firm A currently is overpriced relative to the firm’s business prospects. An investor predicts the stock price subsequently will fall. They can make a bet on their conviction via a variety of financial products; one of which is a short sale.

What are short sale and short squeeze?

In a short sale transaction, an investor borrows shares of firm A’s stock through a trading account with a brokerage firm. The same investor immediately sells those borrowed shares on the market and receives the proceeds from the sale at the current “high” price.

If the stock price ultimately falls as predicted, the investor can buy back shares of firm A’s stock on the market at the new lower price to repay their borrowed shares to the brokerage firm. The profit to the investor is the difference between the proceeds from the sale at the current “high” price and the cost to buy back the shares to repay the brokerage firms, net of some interest rate (referred to as call money rate) charged by the brokerage firm for this borrowing.

However, if the stock price is increasing, the investor is now faced with higher costs to buy back the shares to repay the borrowing. In theory, there is no limit to how high the stock price can rise. The investor ends up having to buy the shares back at higher prices or to add more “cash margin” or “collateral” in their brokerage account.

This is called a short squeeze.

GameStop and the Saga of Short Selling

GameStop offers games and entertainment products in its over 5,000 retail stores and online. The company’s business was struggling even before the COVID-19 pandemic struck due to competition from Amazon and other digital marketplaces.

Recognizing the declining business prospects of the company and predicting a decline in the stock price, several hedge funds, such as Point72 Asset Management, Andrew Left’s Citron Capital and Melvin Capital, among others, short sold the stock, hoping that the stock price would ultimately fall and they could buy back the stock at cheaper price and pocket the difference. Such short sale transactions are nothing new. What is new this time is how individual investors banded together to combat these hedge fund short sellers.

When Ryan Cohen, the founder of Chewy.com, purchased a large number of GameStop shares in August 2020, analysts and investors took this as a sign that the company would incorporate more online commerce into its business model. The stock price started climbing, imposing short-squeeze risk on the hedge fund short sellers.

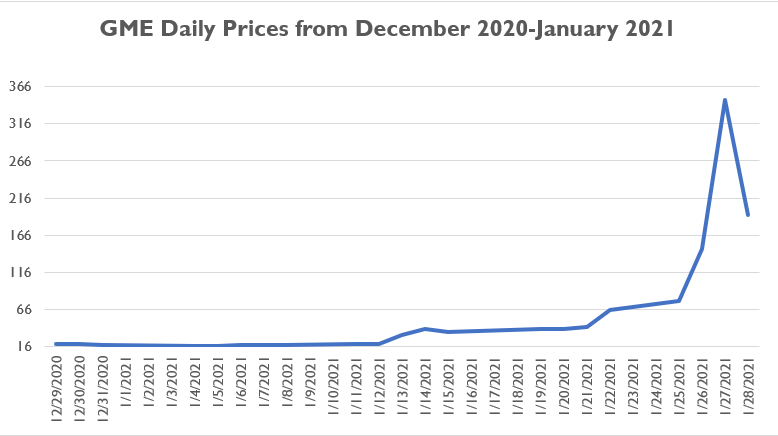

Then individual investors on the popular subreddit WallStreetBets, which boasts 6 million members as of Jan. 29, 2021, began paying attention to the huge amount of short sale positions on GameStop and thus the need by these short sellers to ultimately buy back the shares. The individual investors banded together to buy the stock. As a result of such massive buying pressure by members of WallStreetBets, the stock price has surged more than 1,900% over the course of one month since Dec. 2020.

See the chart below.

On Jan. 26, 2021, Melvin Capital closed out its short position in GameStop. Citron took the same decision on the next day. On Jan. 27 and Jan. 28, 2021, brokerage firms including Fidelity, TD Ameritrade and Robinhood took steps to limit trading on GameStop, sparking the outcry by members of WallStreetBets and even some members of Congress about the unfair treatment of small investors. Shares of GameStop, however, extended an overnight rally in premarket trading Jan. 29, after Robinhood announced it would rescind its previous trading limit on the stock.

What next?

The GameStop phenomenon shows how social media can influence investor investment decisions. The buying frenzy by investors on the bandwagon pushed the price way beyond the level that reasonably reflects the fundamentals (such as future earnings and assets) of GameStop’s business. The current GameStop price reflects purely the supply and demand for the stock on the market, or namely by investor sentiment, rather than the fundamentals. Such price can only be maintained if the demand and sentiment can be maintained. However, investor sentiment can wear out, as observed during the tech bubble of 1999-2000.

Such media-driven price hikes might also motivate weak-performing firms to manipulate their stock prices by feeding false information into these trading forum members.

by Dr. Thanh Ngo is a professor of finance in ECU’s College of Business.

by Dr. Thanh Ngo is a professor of finance in ECU’s College of Business.

Disclaimer: Dr. Ngo holds no position in GameStop stock. The discussion in this article does not constitute financial advice.

- Categories:

- Finance